Research and Development Tax Credit Updates

One of the most important tax credits on the table for many businesses is the Research and Development (R&D) Tax Credit. It recognizes businesses for developing and improving products and processes, regardless of industry. There are two significant ways your company can offset these expenses; income and payroll tax credits. There is a lot of information swirling around the internet, so we decided to break it down for you and help you decide if it is something you should be taking advantage of. Here are a few important reminders and quick facts.

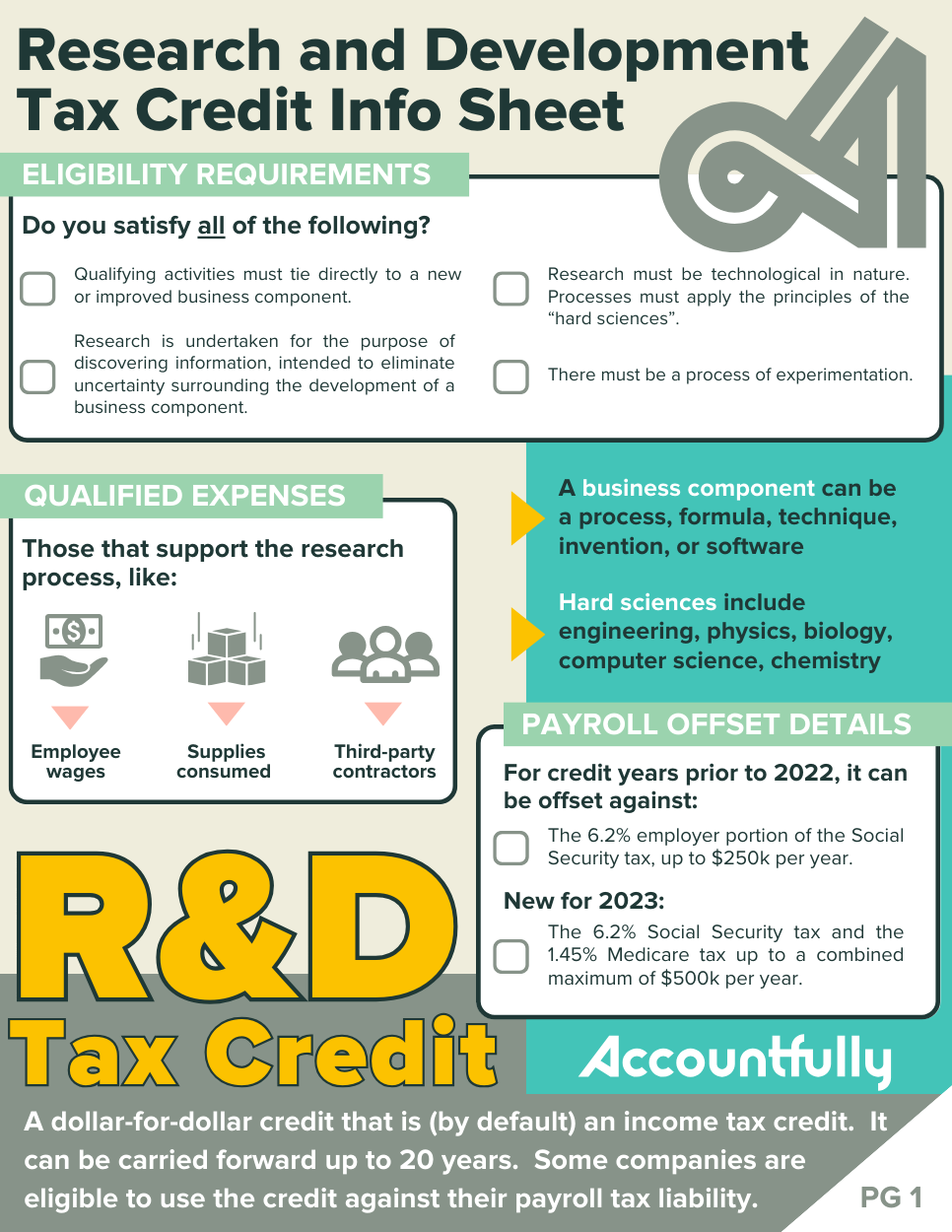

Download our simplified info sheet to keep handy when deciding if the R&D credit makes sense for your business:

The R&D tax credit is a dollar-for-dollar credit that by default is an income tax credit. If there is no income tax liability to offset against, the credit can be carried forward up to 20 years. Alternatively, some companies are eligible to utilize their credit against their payroll tax liability (more on that below). This is an annual credit based on qualified expenses incurred during the company’s fiscal year.

To be eligible for the R&D tax credit, a business must satisfy a four-part test:

As noted above, the default use of the R&D tax credit is offsetting it against the company’s income tax liability. Additionally, flow-through entities such as partnerships and S Corporations, pass the credit out to their owners for use on their income tax returns (subject to potential limitations).

Another option is to utilize the credit against the company’s payroll tax liability. In 2015, Congress passed a law that allows certain businesses to utilize the credit as an offset against the company's payroll tax liability; specifically the 6.2% employer's portion of social security tax, up to a maximum of $250,000 per calendar year.

Beginning with the 2023 calendar year, the credit can now be applied against the 1.45% Medicare tax, and the maximum was increased to $500,000.

if your business has had at least $1 of gross income every year but hasn't had more than five million dollars of gross revenue in any of those years, then it would be eligible for the payroll tax offset for the first five years of existence. In year six and beyond, they would only be able to claim the income tax credit. Many of Accountfully’s clients fall into this category. Companies eligible for the payroll tax offset will feel the cash flow benefits of the credit more quickly since these companies are often not profitable in the early stages and thus do not have an income tax liability.

For companies electing the payroll tax offset, Form 8974 is then filed with your quarterly payroll tax returns (941s) to capture the credit. This form determines the amount of qualified small business payroll tax credit you will receive for increasing research activities that can be claimed on your employment tax return.

The time frame of seeing the result of this credit can vary depending on both the size of the credit and the company’s employer’s social security tax–and Medicare tax beginning in 2023. It may take several quarters for the full credit to be received.

You should not begin capturing the credit against your payroll tax liability until the first quarter beginning after your income tax return is filed. For example, an income tax return filed on September 27, 2023, should start claiming payroll credit on its Q4 2023 941. An income tax return filed on October 2, 2023, should start claiming their payroll tax credit on Q1’s 2024 941.

Procrastinators take note. The opportunity to elect to treat your R&D credit as a payroll tax offset will be missed if you do not include Form 6765 with your income tax return on or before the due date, including extensions. Should you have a formal study done, they will provide this form–more on that below.

The payroll tax election cannot be claimed on a late-filed or an amended tax return filed after the due date. There is no workaround for this.

While Accountfully’s Tax team will do their best to remind you of this and ask follow-up questions if we believe you could qualify for the credit, the onus is on you as a business leader to ensure you take advantage of the opportunity.

Once you have established that your business meets the R&D credit parameters, the next decision to make is whether or not to have a formal study done. Accountfully’s Tax team will typically have conversations with clients surrounding their R&D-related expenses and can support taking advantage of the credit, but we do not officially provide formal studies as a service. However, we are happy to support you in the process, should you elect to have one done. There is no shortage of emails offering this service to inventory-based business owners. Our team can be a sounding board for choosing one.

Once you have identified that there are a lot of R&D activities and expenses at play, the next step is to decide if a formal study is right for you. Considering the tax benefits available, getting a formal study done is a great choice.. Not only does it streamline the process of claiming the credits and help maximize its impact, but it also gives you more powerful audit support, should one come up. If you are audited, there are substantial qualitative documentation requirements that will need to be produced to show your research and development efforts. Third-party providers prepare this supporting documentation if needed. Typically these providers will include a certain amount of audit support as part of their fee.

Most of these providers will take a percentage of the total credit. You can expect to pay between 20% and 30%. This likely includes the above-mentioned audit support, the full report they prepare, and a pro forma Form 6765. This, as you may have guessed, is the form used to claim the R&D credit on your tax return.

If you use Accountfully to file your taxes and have had a formal study done, you are in great shape.

We will include it with your year-end tax documents using our secure and efficient process in Onvio. We will include the prepared Form 6765 with the election to utilize the credit against your payroll tax liability, should you be eligible and choose this option.

The R&D credit can significantly help cash flow for companies actively participating in research and development. As your outsourced accounting team, we will prompt you to share details of R&D-related items we spot on your P&L, but we can’t fully assess your R&D Credit qualifications like a firm that specializes in this exercise can. If you are a business that spends money and time on research and development activities it is worth assessing your qualifications through a formal study. Once we have the prepped forms and information, we can include them with your regular tax filing.

This important tax credit could positively affect a smaller company’s cash flow and should be taken advantage of if applicable.

To best capitalize on this credit, make sure to engage in a formal study and prepare everything so that you are meeting deadlines and not missing out as a result of bad planning. In the meantime, Accountfully’s Tax team is available to talk through this with you.